rivian stock price valuation

In November the electric-vehicle manufacturer raised its IPO price to 78 from a previously expected price range of 72 - 76. Tom Bemis Oct 1 2021 702 PM EDT Rivian an electric vehicle maker with big name backing has filed.

Rivian Stock Price Prediction 2022 Is Rivn A Buy In 2022

Whats more Rivian has already delivered a ton of excitement to believers sporting gains of 120 from its initial public offering IPO price.

. Rivian stock has bounced off its all. This suggests a possible upside of 1019 from the stocks current price. At its peak Rivian was valued at more than 116 billion making it bigger than companies like Ford and General Motors which sell millions of cars every day.

There are many factors that companies consider before their listing date including. Fair Value of RIVN stock based on Discounted Cash Flow DCF 1M-2574 3M-2141 Price 4693 Fair Value 5144 Undervalued by 876 RIVN price to book PB For valuing companies that are loss-making or have lots of physical asset Company -1171x Industry 331x RIVN s financial health Profit margin Revenue 10M Net Income -12B Profit Margin. At this time the company appears to be fairly valued.

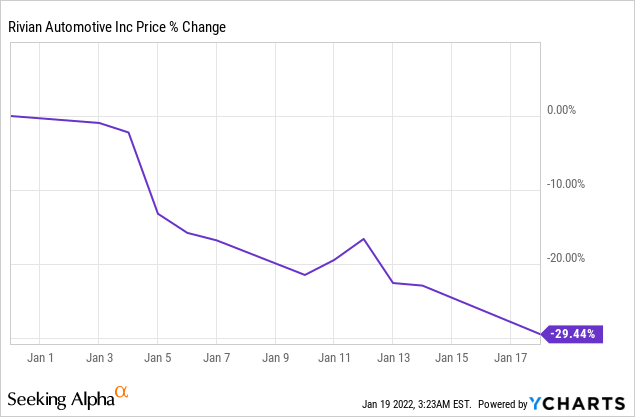

Rivian hasnt scheduled its IPO or set the terms yet. Rivian Automotive RIVN -756 stock may be down over 50 so far in 2022 but some investors believe that has been enough of a drop to make it time to buy. Ford Motor and D1 Capital Partners are the most recent investors.

Mizuho analyst Vijay Rakesh who cut Rivians price target to 100 a share from 145 per share in early March now sees the stock rising to 95 a share. Rivian has a post-money valuation in the range of 10B as of Jan 6 2021 according to PrivCo. The 78 rivian ipo price indicated high demand and a 77 billion valuation.

It uses Rivian Automotives balance sheet items such as long-term debt the book value of the preferred stock minority interest and other important financials. Electric vehicle maker backed by Amazon and Ford said to be targeting late November offering. The stock is trading at 6629 about 63 below its all-time high.

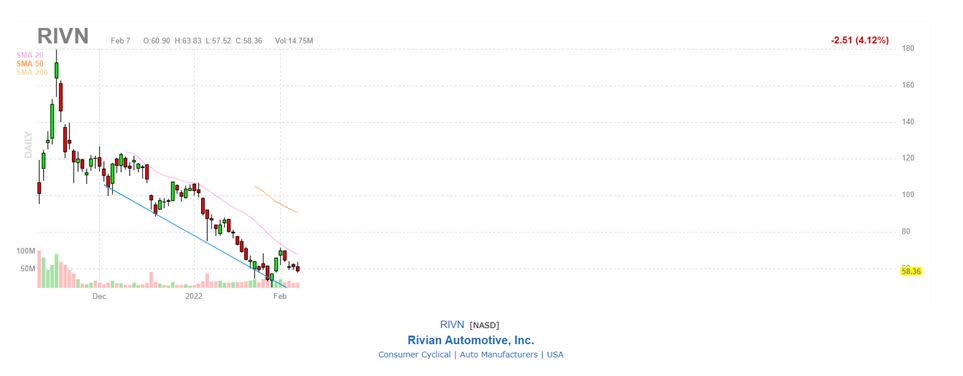

Rivian Stock Price History In feb the negative dynamics for momo shares will prevail with possible monthly volatility of 19916 volatility is expected. This scheduled battery factory is set to open near Atlanta. The average volatility of media hype impact on the company stock price is over 100.

Rivian Automotive stock immediately soared to 17947 before. Rivian is an EV startup located in Irvine California that went public in November 2021. Rivian is anticipated to increase in value after the next headline with price projected to jump to 4637 or above.

Instead investors may be taking a second look at the EV stock and seeing a buying opportunity after its share price plummeted over the past six months. Rivian is funded by 19 investors. This news came in by unnamed sources in a Bloomberg report.

Their forecasts range from 4000 to 17000. Rivian is registered under the ticker NASDAQRIVN. Rivian Automotive Inc Cl A stocks price quote with latest real-time prices charts financials latest news technical analysis and opinions.

An amount from these incomes is set to be invested in making a factory for the electric battery. But if we view it through a wider lens we. Capitalization or market value of a stock is simply the market value of all outstanding shares.

As a result the companys total market capitalization has dropped to about 599 billion. No analyst has rated the stock a Sell and. The price upswing on the next news is forecasted to be 169 whereas the daily expected return is at this time at -102.

The highest estimate for the stock stands at 130 and the lowest at 35. On average they anticipate Rivian Automotives share price to reach 9321 in the next year. At an average price of 75000 just above what its currently charging for orders at full capacity Rivian would bring in around 37 billion.

Their stock opened with 7800 in its Nov 10 2021 IPO. That sounds like enough to justify a valuation of 100 billion today but using a modest discount rate of 5 that 5 billion would be worth just. The prevailing price of the company is 4356.

Back then the stock was priced at 78 per share but it has progressively slid after hitting a surprise post-IPO high of 180 per share. The average Rivian price target is 7608 suggesting 514 upside potential. Putting Rivians Valuation in Perspective Without a doubt Rivians implied valuation sets a higher bar than even Lucid.

Rivian was up by 106 as of 1140 am. 16 brokerages have issued twelve-month target prices for Rivian Automotives stock. It is computed by multiplying the market price by the number of outstanding shares.

The electric vehicle maker has been public for all of one week but its share price has more than doubled in that time valuing Rivian at more than 140 billion just ahead of Volkswagen 139. This gave it 281 billion in financing cash flows. In 2019 Rivian brought in 275 billion from issuing stock and 61 million from issuing debt.

As mentioned before RIVN stock has its valued price of 140 billion as of mid-November. Rivian Automotive holds a recent Real Value of 4149 per share. Yes the price of Rivian stock has declined 51 this year as the markets have adopted a risk-off attitude.

Amazon Backed Ev Maker Rivian Raises 11 9 Bn In Year S Biggest Ipo Business Standard News

Rivian Stock Has Become A Bargain Nasdaq Rivn Seeking Alpha

Rivian Stock Price Prediction 2025 Rivian Forum Rivian R1t R1s News Pricing Order

Rivian Prices Ipo At 78 A Share Valuing Company At 66 5 Billion

Rivian Shares Plunge 15 In Two Days After Amazon Signs Deal With Rival

Rivian Fisker Get Pummeled Amid Stock Market Selloff Dot La

Rivian Raises 2 5 Billion As It Pushes To Bring Its Electric Rt1 Pickup R1s Suv To Market Techcrunch

New 2021 Rivian R1t Reviews Pricing Specs Kelley Blue Book

Rivian Valued At Over 100bn In Debut World S Biggest Ipo Of 2021 Nikkei Asia

Is Rivian Stock A Buy Now As Analyst Touts Positive Outlook Investor S Business Daily

Rivian Rivn Stock Jumps Past Volkswagen S Valuation As Ev Mania Rages Bloomberg

:max_bytes(150000):strip_icc()/RIVN_2021-11-13_17-55-38-02749a2062a94fcfad9de55c55444c5f.png)

Rivian Ipo Rivn Went Public At 78 00 On Nov 10 2021

Rivian Shares Fall For First Time Since Blockbuster Ipo

Ford S Stake In Ev Truck Start Up Rivian Is Worth More Than 10 Billion In First Day Of Trading In 2021 Start Up Ev Truck Make Millions

Rivian Stock After 30 Drop In 2022 Investors Are Overpaying Seeking Alpha

Rivian Stock A Truly Scary Valuation Nasdaq Rivn Seeking Alpha

Rivian Pre Order Customers Made Over 240 Million In Profit On Ipo Pop

Rivian Aims For Up To 54 6 Billion Valuation In Upcoming Ipo